Micron: AI’s popularity cannot fill the “downcycle pit”.

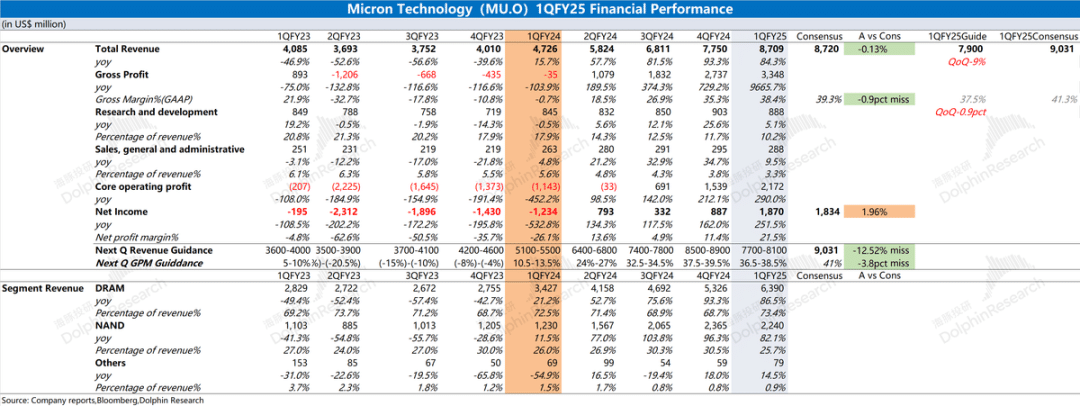

Micron (MU.O) released its financial results for the first quarter of the fiscal year 2025 (ending November 2024) after the US stock market closed on the morning of December 19, 2024, Beijing time. The key points are as follows:

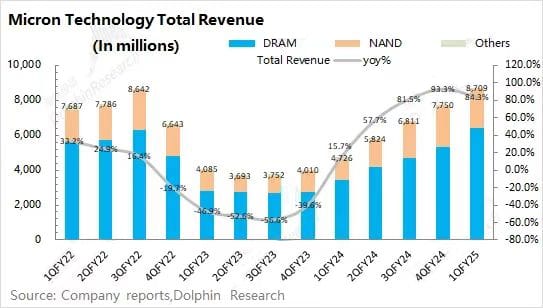

- Overall Performance: Revenue met expectations, but gross margin faced challenges. Micron’s total revenue for the first quarter of the fiscal year 2025 was $8.7 billion, an increase of 84.3% year-over-year, in line with market expectations ($8.72 billion). The revenue continued to rebound, driven by the company’s DRAM business growth. Micron achieved a net profit of $1.87 billion in the first quarter of the fiscal year 2025, with profits continuing to improve. Driven by the volume of HBM and the rise in storage product prices, both the company’s revenue and gross margin saw significant improvements, leading to a noticeable improvement in the company’s bottom line.

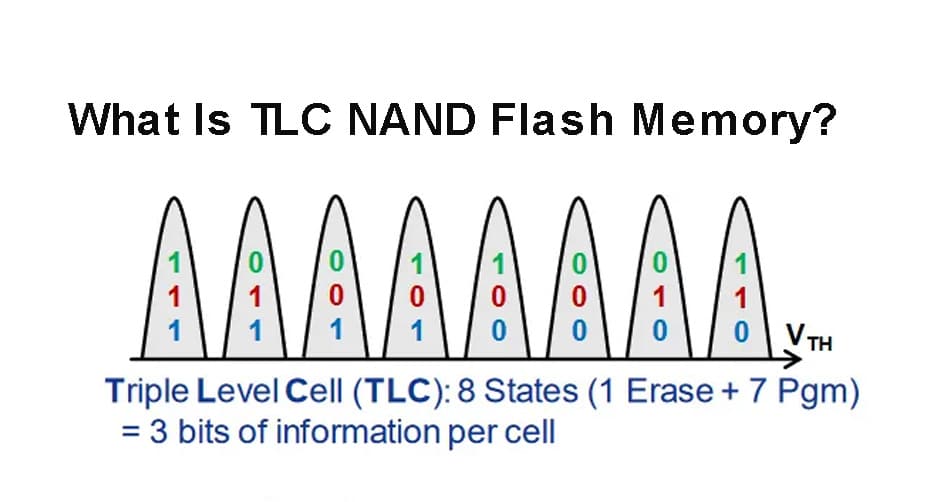

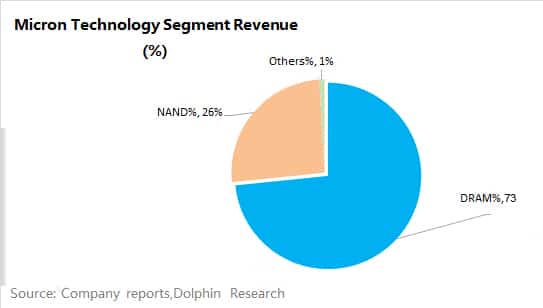

- Business Segment Performance: HBM is the main driver of performance. DRAM and NAND account for 99% of the company’s revenue, and HBM was the main driver of performance growth this quarter. Specifically, while both DRAM and NAND businesses saw significant year-over-year growth, there was a clear divergence on a quarter-over-quarter basis. DRAM business still grew by 20% quarter-over-quarter, while NAND business declined by 5%. This was mainly because DRAM continued to grow under the impetus of HBM, while the weakness in demand in traditional areas directly led to a quarter-over-quarter decline in NAND business.

- Outlook for the Next Quarter: Revenue for the second quarter of the fiscal year 2025 is expected to be between $7.9 billion and $8.1 billion (a quarter-over-quarter decline of 9%), below the market consensus expectation ($9 billion); the quarterly gross margin (GAAP) is expected to be between 36.5% and 38.5%, which is also a quarter-over-quarter decline and below the market consensus expectation (41.3%).

- Overall view: The financial report for this quarter was somewhat satisfactory, but the guidance for the next quarter was disappointing. Micron’s revenue and gross margin continued to rebound this quarter, but the gross margin performance did not meet market expectations. Although HBM is still contributing to the company’s growth, the company was affected by traditional downstream markets such as mobile phones this quarter, leading to a decline in prices for some storage products, which in turn affected the gross margin performance. Looking at the business segments, the company’s DRAM business still saw a 20% quarter-over-quarter growth this quarter. Driven by HBM, the DRAM business continued to show an increase in both volume and price; however, the company’s NAND business declined by 5% quarter-over-quarter. This was mainly due to the impact of inventory adjustments in downstream sectors such as mobile phones, automobiles, and industry, with a slight quarter-over-quarter decline in both shipment volume and average price of related storage products. Compared to this quarter’s financial report, the company’s outlook for the next quarter is indeed “poor.” It not only interrupted the company’s continuous growth in revenue for seven consecutive quarters but also saw a decline of nearly $800 million quarter-over-quarter, and the gross margin may also decline quarter-over-quarter. This will undoubtedly add more concerns to the market: 1) Has the company’s current storage upcycle ended? 2) Is the company’s HBM business growth hindered? This directly led to a 16% decline in the company’s stock price after the market closed.

- Considering the industry and the company’s operating conditions, the decline in revenue for the next quarter is still mainly affected by sectors such as mobile phones and automobiles. From several perspectives: 1) The traditional areas are still in the inventory adjustment phase, and the company expects to gradually stabilize after the second half of the fiscal year 2025 (after March 2025 in the calendar year); 2) The company has further increased its total market size expectation for HBM next year to $30 billion (originally expected to be $25 billion), which shows the company’s confidence in the HBM business; 3) Recent rumors about NVIDIA adjusting the shipment structure of B200 and B300 will also affect the rhythm of Micron’s HBM to some extent. Overall, Micron’s current business includes both traditional storage demand and AI-related demands such as HBM. The company’s current performance is still mainly affected by traditional businesses, and the current downturn in traditional areas will directly affect the company’s subsequent business. As for the growth-oriented HBM business that the market is concerned about, although the current revenue share is still less than 10%, the company’s growth expectation for next year continues to be revised upwards. Therefore, the company’s performance will be under pressure in the first half of the fiscal year 2025, and with the destocking of downstream and the volume of HBM, the company’s performance is expected to see a significant improvement again in the second half of the year.

I. Overall Performance: Revenue meets expectations, but gross margin faces obstacles

1.1 Revenue

Micron’s total revenue for the first quarter of the fiscal year 2025 was $8.71 billion, a year-over-year increase of 84.3%, in line with market expectations ($8.72 billion). The revenue rebounded year-over-year, mainly driven by the price increase of the company’s storage products, with the average selling price of the company’s DRAM and NAND products both increasing by more than 60% year-over-year.

On a quarter-over-quarter basis, the company grew by 12.4%. Among them, the DRAM business still saw a 20% quarter-over-quarter growth this quarter, driven by HBM demand, while NAND saw a 5% quarter-over-quarter decline, mainly due to the impact of downstream inventory adjustments in the mobile phone, automotive, and industrial sectors.

1.2 Gross Margin

Micron achieved a gross profit of $3.348 billion in the first quarter of the fiscal year 2025, and the company’s quarterly gross profit continued to rebound. The company’s gross margin for this quarter was 38.4%, lower than market expectations (39.3%). The increase in gross margin was mainly due to the rise in the average price of DRAM products and their proportion, but the weakness in some downstream sectors affected the extent of the rebound in gross margin. Although the company’s current inventory is $8.705 billion, a quarter-over-quarter decline of 1.9%. With the recovery in sales and the destocking of some downstream sectors, the company’s inventory turnover speed has increased, further adjusting the company’s inventory structure.

1.3 Operating Expenses

Micron’s operating expenses for the first quarter of the fiscal year 2025 were $1.176 billion, a year-over-year increase of 6.1%. With the growth in revenue, the company’s operating expense ratio for this quarter decreased to 13.5%. Looking at the breakdown of expenses: 1) Sales and administrative expenses: $288 million this quarter, a year-over-year increase of 9.5%. The sales and administrative expense ratio was 3.3%, a year-over-year decrease of 2.3 percentage points, with the decrease in proportion mainly due to the increase in revenue. Sales expenses are related to revenue performance, while administrative expenses are relatively rigid; 2) Research and development expenses: $888 million this quarter, a year-over-year increase of 5.1%. R&D expenses are the largest source of the company’s operating expenses, with the R&D expense ratio declining to 10.2% this quarter. As a technology company, the company places more emphasis on R&D capabilities, and the company’s R&D expenses are maintained at a relatively high level.

1.4 Net Profit

Micron achieved a net profit of $1.87 billion in the first quarter of the fiscal year 2025, in line with market expectations ($1.83 billion). The company’s profit growth this quarter was mainly due to the growth of the DRAM business and the improvement in gross margin. In this quarter, the company’s net profit margin was 21.5%, with a significant increase in profitability. Among them, the company’s operating profit for this quarter reached $2.1 billion, which has reached a relatively high position in the past cycle.

II. Business Segment Performance: HBM is the Main Driver of Performance

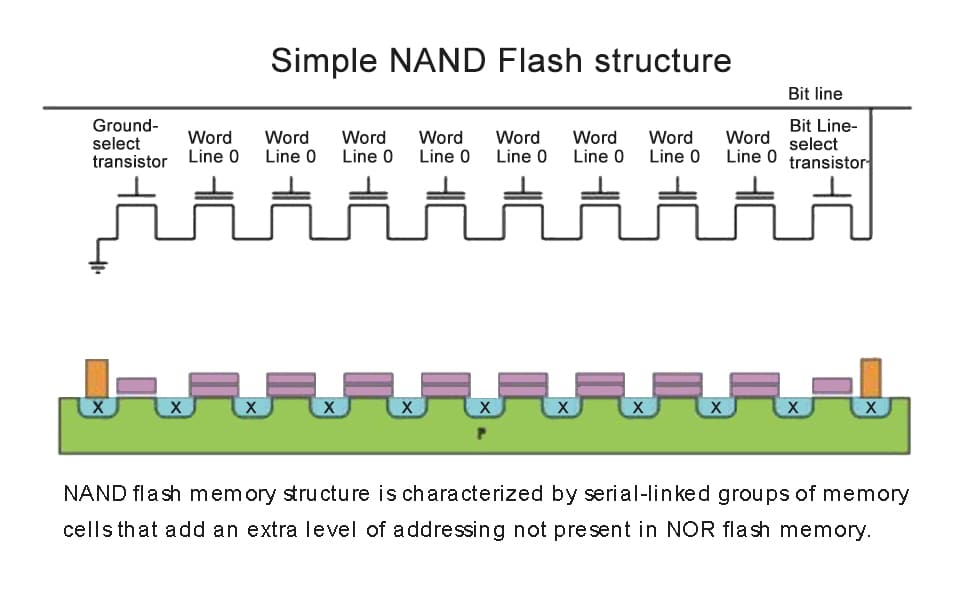

From the previous in-depth analysis by hugdiy.com on Micron in “Micron: Has the Winter for the Memory Chip Giant Ended?”, the company’s largest source of revenue is memory chips. According to the latest financial report, DRAM and NAND remain the most important sources of revenue for the company, accounting for 99% combined. Therefore, the changes in Micron’s business mainly depend on the performance of DRAM and NAND businesses.

2.1 DRAM

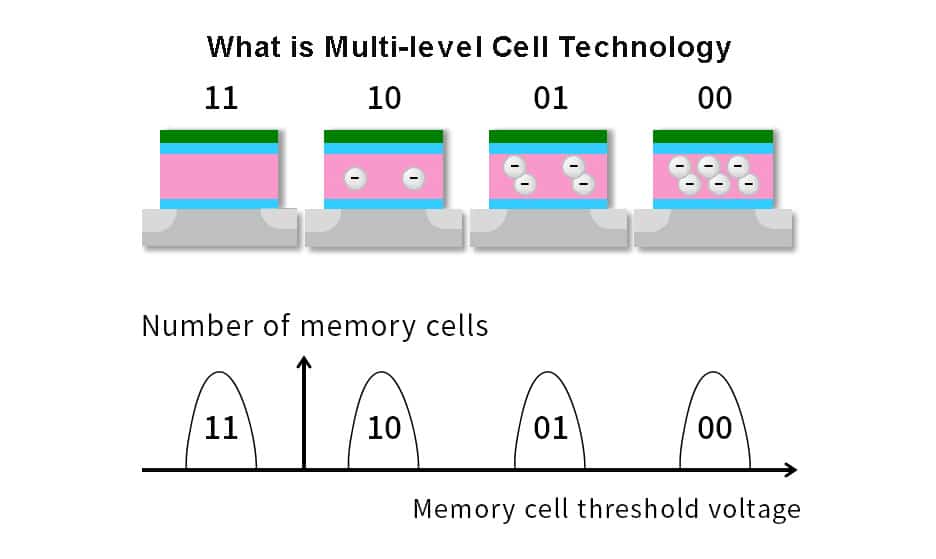

DRAM is the company’s largest source of revenue, accounting for more than 70%. In this quarter, the company’s DRAM business revenue increased to $6.39 billion, a year-over-year increase of 86.5%. Considering the performance of downstream sectors such as mobile phones and automobiles, Dolphin Jun believes that the $1 billion increase in DRAM business quarter-over-quarter is mainly driven by the demand for cloud server DRAM and the revenue growth of HBM. In terms of volume and price performance: the company’s DRAM business grew by 20% quarter-over-quarter this quarter, with shipments increasing by about 7% quarter-over-quarter, and prices also recovering by about 8%. The performance of both volume and price increase this quarter is mainly brought by the demand for cloud servers, while some products in traditional fields face price pressure. Taking DDR4 16G (1G16) 3200Mbps as an example, the product price has risen from a low of $2.89 in September 2023 to a high of $3.81 and then gradually fell to $3.09, and then rose again to $3.18 in December, while the average price in the company’s current fiscal quarter is clearly under pressure. Regarding the HBM field, which the market is concerned about, the products of the current industry leaders have all been updated to the latest HBM3E, among which SK Hynix and the company’s products have already been supplied to NVIDIA. According to YOLE, HBM products will be updated to the next generation of HBM by 2026. As for the market’s concerns about the company: 1) the sustainability of HBM growth; 2) competition from Samsung. Although there have been reports that Samsung has completed the core certification of NVIDIA, from the industry chain information, Samsung’s scale that can be mass-produced in the H200 product cycle is limited. As for the overall HBM total market size (TAM), the company has raised its expectation for 2025 to over $30 billion. Currently, the company’s share in HBM is only in the single digits, but in the future, the company is expected to increase its share to about 20%, which is comparable to its DRAM market share. As for the competition between GPUs and ASICs, both require HBM. As long as the overall market grows, the demand for HBM will continue to increase. The specific difference is that B200 and MI325X require HBM3E, while products like Google’s TPU v6 require HBM3, with slightly slower performance iteration requirements.

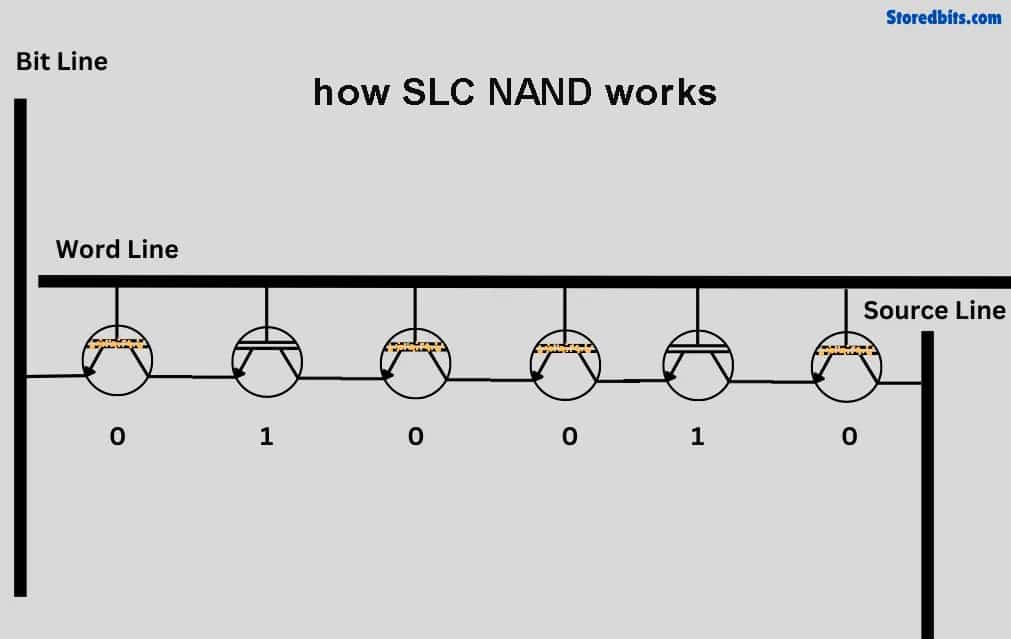

2.2 NAND

NAND is the company’s second-largest source of revenue, accounting for 26%. In this quarter, the company’s NAND business revenue was $2.24 billion, a year-over-year increase of 82.1%. The year-over-year growth of NAND is mainly driven by the recovery of product average prices from the bottom. However, on a quarter-over-quarter basis, this quarter began to decline, mainly due to the weak demand in traditional downstream sectors such as mobile phones and automobiles. The market originally expected that the company’s downstream would gradually recover from the trough through inventory adjustments. However, from the current performance, the inventory adjustments of the company’s downstream are still continuing, and it may not improve until the second half of the next fiscal year. In terms of volume and price performance: Micron’s NAND business declined by 5% quarter-over-quarter this quarter, with NAND shipments declining by about 2% quarter-over-quarter, and the average price of NAND shipments declining by about 3%. Looking at the product prices in the market, NAND Flash (128Gb 16G8 MLC) has fallen from $4.9 to around $3.