Latest Posts

The chip market is changing due to excessive inventory

TSMC Warns of “Excessive Inventory” as Intel Prepares 20% Chip Price Hike: Semiconductor Industry Faces Turbulence Global chip demand uncertainty triggers supply chain chaos.

1. SK Hynix Considers 2023 Capital Expenditure Cuts Amid Memory Chip Market Uncertainty

Bloomberg reports weakening demand across smartphones, PCs, and servers has forced SK Hynix, a leading memory chip manufacturer, to consider slashing 2023 capital spending by 25% to 16 trillion won ($12.2 billion). The company confirmed it has not finalized its expenditure plan, highlighting the volatile cyclical nature of semiconductor supply and demand dynamics.

SK Hynix’s potential budget reduction underscores broader industry challenges. Memory chip fluctuations heavily influence semiconductor trends, with both supply chain disruptions and slowing consumer demand contributing to market instability.

2. PC Market Slump Threatens Chip Supply Chain with Price Reductions

PC manufacturers are bracing for a weak peak season in H2 2023, sparking aggressive price wars in slow-moving markets like China, North America, and the Eurozone. Domestic sales in China plummeted 20%-30% compared to 2021, pressuring brands to prioritize inventory reduction. Analysts warn this could cascade into widespread chip supply chain price cuts.

The shift from component hoarding during shortages to inventory liquidation reflects worsening demand. Downstream ODMs and upstream suppliers alike face pressure as panel, processor, and memory IC prices decline. A poor Q3 sales performance may trigger deeper discounts.

3. TSMC’s Record Profits Mask Semiconductor Inventory Crisis

Despite posting a 76% profit surge in Q2 2023, TSMC warned customers of “overstocked inventory” threatening its outlook. As the world’s largest foundry, TSMC supplies Apple, Qualcomm, and Nvidia, making its performance a critical demand indicator for electronics.

President C.C. Wei acknowledged customers are clearing pandemic-era stockpiles, weakening demand for consumer electronics chips. “Inventory rebalancing may extend into early 2023,” he stated, signaling prolonged turbulence for the semiconductor industry.

4. Intel Confirms Chip Price Increases Up to 20% Amid Inflation Pressures

Intel announced plans to raise CPU and peripheral chip prices this fall, citing inflation-driven cost hikes. Increases will vary by product, ranging from single digits to 20%, affecting server CPUs, Wi-Fi chips, and PC components.

The company confirmed the move aligns with Q1 2023 guidance on inflationary challenges. Analysts warn the hikes could further strain OEMs already grappling with weak consumer demand.

5. Ingenic Reports 30% Q1 Growth in NOR Flash Amid Automotive Demand

Beijing-based Ingenic, a leader in CPU technology, reported over 30% growth in NOR Flash products in Q1 2023, driven by automotive applications. However, shrinking fab capacity and stagnant NAND prices signal softening demand in other sectors.

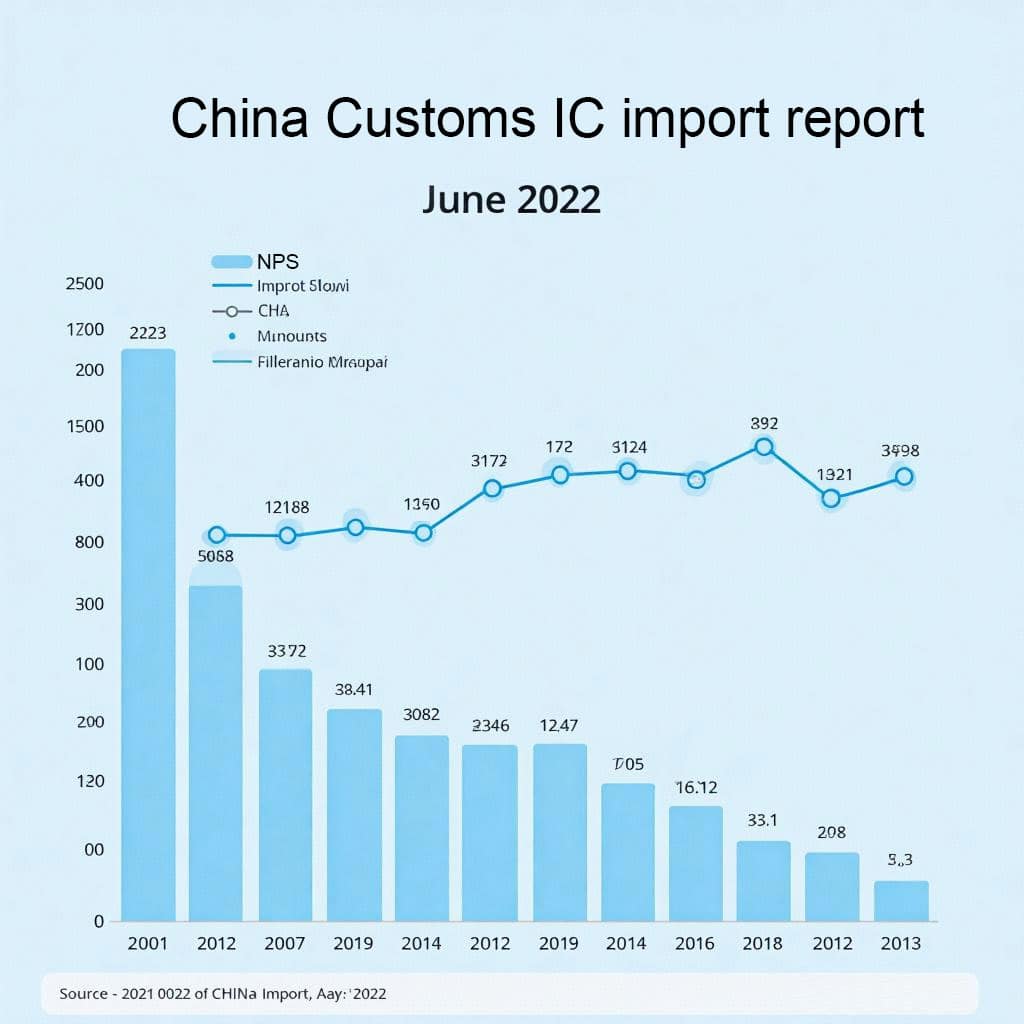

6. China’s IC Imports Drop 8.3% in June Amid Global Chip Glut

China’s General Administration of Customs revealed a 8.3% year-on-year decline in integrated circuit imports for June 2022, totaling 47.66 billion units. H1 2023 imports fell 10.4%, though import value rose 5.5%, reflecting mixed pricing trends amid oversupply.

Leave a comment