Latest Posts

Storage market experienced the biggest quarterly decline in the first quarter of 2019 during eight years

According to the latest survey reported by DRAMeXchange, due to oversupply in Q1 of 2019, most transactions in the DRAM industry have changed to monthly deals. In addition, prices also fell sharply in February, and the quarterly decline has been adjusted from 25% initially to nearly 30%, which was the biggest quarterly decline since 2011.

DRAMeXchange pointed out that from the perspective of the market, after overall contract prices began to decline in the fourth quarter of last year, the inventory level continued to rise.

Recently, DRAM inventory (including wafer inventory) have generally been at high level of at least one month and a half. In the case of sluggish demand, even PC-OEM was unable to digest DRAM particles from suppliers, it is resulted that overall market presented a trend of endless decline.

This means that even if the Fab is willing to sell its products at low price, it will not be able to effectively stimulate sales. Once demand does not return strongly, high inventory will cause continuously price reduction in DRAM this year.

Looking forward to DRAM market in two years, the competition among three giants in market share will not stop. SK Hynix has announced it will invest $107 billion to build four fabs with the aim of maintaining its competitive edge, while Micron Group has devoted its efforts to build packaging and testing plants in Taiwan.

Meanwhile, Micron Memory is considering building one new 12-inch DRAM plant, which may be completed by the end of next year and put into operation in 2021. Samsung is building a second plant in Pyeongtaek.

TOP 10 memory chip suppliers ranking in integrated circuit getting change

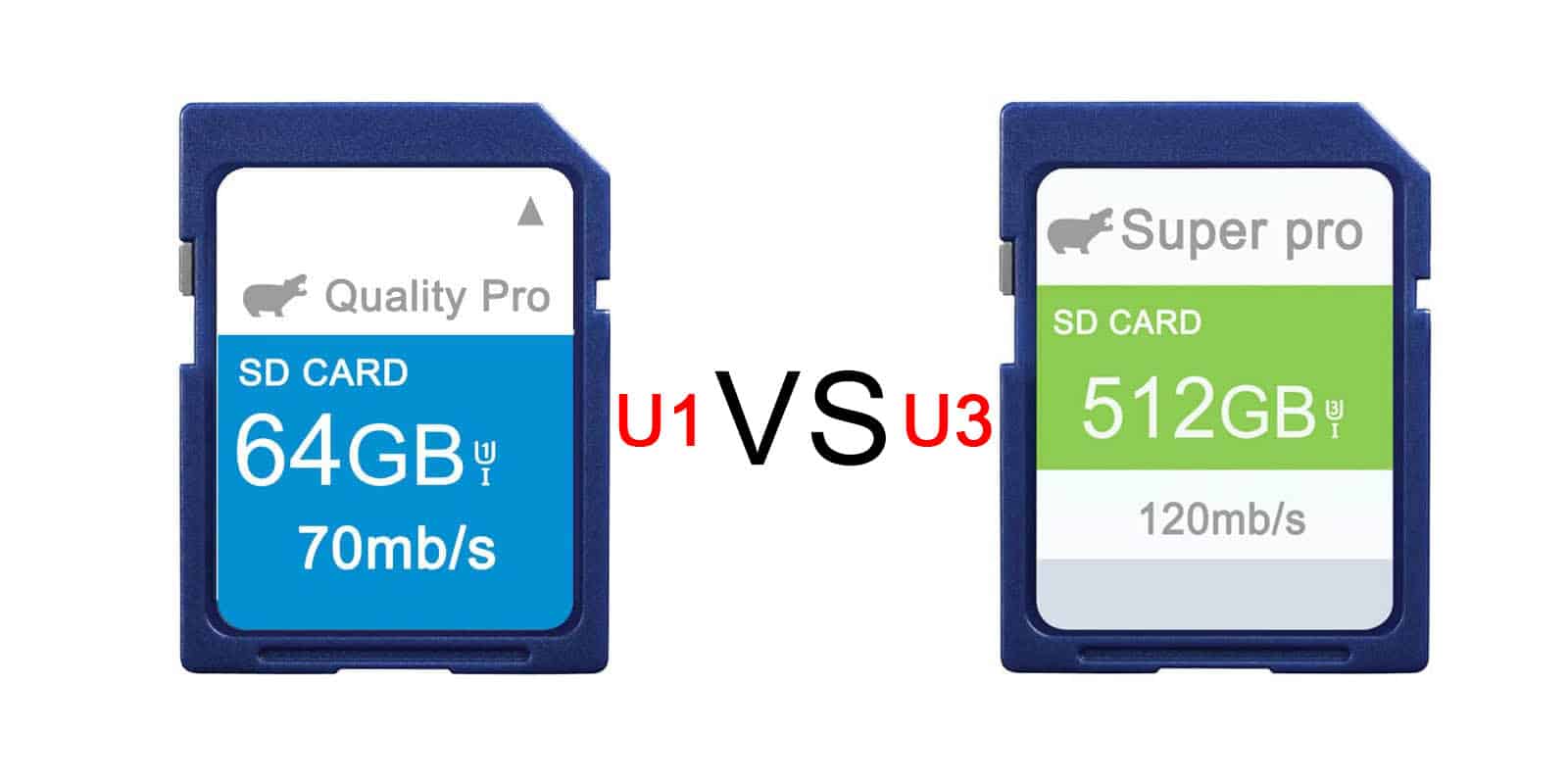

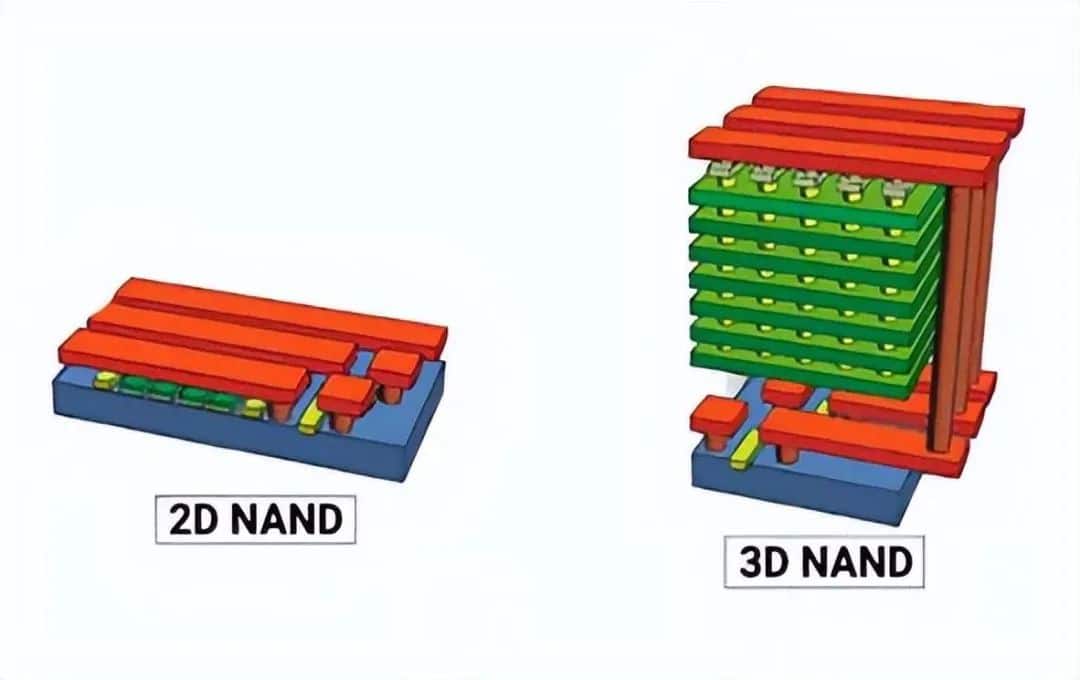

Since 2016, the demand for memory in personal computers (PC) and mobile phones has gradually increased. For instance, the memory of personal computer was shifted from HDD to SSD, together with increasing capacity of DRAM. Besides, the capacity of NAND flash and DRAM for smartphones was increasing. Such two factors contributed to a rapid growth in overall memory market.

Samsung ranked first on global semiconductor revenue for the year of 2017 and 2018, which was mainly because prices increases in memory and flash drove Samsung’s revenue growth over the past two years.

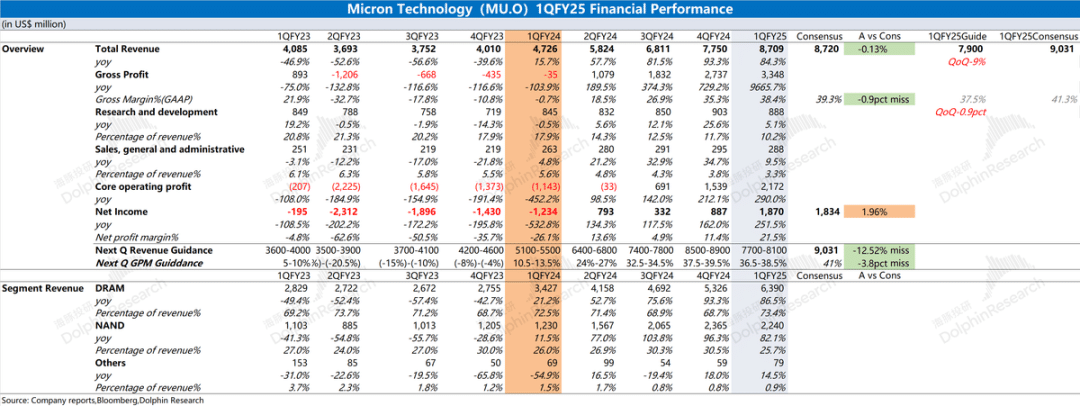

However, the prosperity of Samsung may have to end in 2019. According to the forecast of IC Insights, faced with the cooling of memory chips (DRAM and NAND Flash), annual revenue of Samsung semiconductor will fall by 20% year on year, while that of Intel is basically stable. As a result, Intel will return to rank first, followed by Samsung.

Revenue in the storage market will fall by 24% this year, leading to a decline of about 7% in the semiconductor industry. In terms of Samsung, 83% of semiconductor revenue depends on memory chips, so the impact is huge.

In addition, the revenue of top 10 memory chip suppliers, including SK Hynix, Micron and Toshiba, will also drop by more than 20%. Revenue of the three suppliers, namely SK Hynix, Micron and Toshiba, are expected to fall as low as that in 2017.

In the Q1 of 2019, memory and flash revenue among Samsung, SK Hynix and Micron plummeted 29%.

Over the past two years, DRAM memory and NAND flash had experienced ups and downs, which also led to continued turbulence in memory modules and SSDs.

The three giants, who master core chip resources, have naturally made a lot of money, and even deliberately depressed their capacity to control the market.

Along with the time going on, the market suddenly changes. Affected by seasonal factors, inventory backlog, price reduction and so on, the three giants are getting worse and worse.

Digitimes reported in the fourth quarter of 2018, the total revenue of Samsung Electronics, SK Hynix and Micron in memory and flash memory decreased by 26% year-on-year and 18% quarter-on-quarter, with memory accounting for 17% and flash for 20%.

As the price of memory chips continued to decline, both smartphones and servers downstream channels worried that inventory was difficult to digest, and were cautious about orders.

Memory and flash revenue of the three giants fell by 29% year-on-year and 26% quarter-on-quarter in the first quarter of 2019. Even though Samsung Electronics, SK Hynix and Micron still basically remained the same share of the industry’s total revenue, accounting for 70%.

Leave a comment