Latest Posts

Sluggish consumer demand is directly affecting the memory chip industry.

As reported on August 18, the US financial media recently warned memory chip manufacturers. They must prepare for a harsh shift in the coming months as the global economy faces the recession. The industry may experience its worst recession in decades after experiencing record sales growth during the outbreak.

The Status of Memory Chip Manufacturers

The report noted that orders in the semiconductor market dramatically grew throughout the outbreak. Although some had anticipated the prosperity to persist for several years, memory chip manufacturers are suffering. Because they are currently dealing with the issue of rising inventories and declining demand. Home offices and online education prospered after the epidemic’s global outbreak. It is driving demand for personal computers and other equipment. Therefore, producers of electronic equipment have been even eager to buy chips at any price.

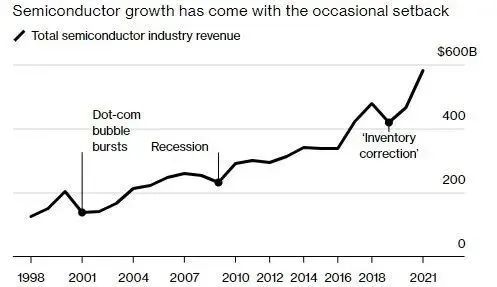

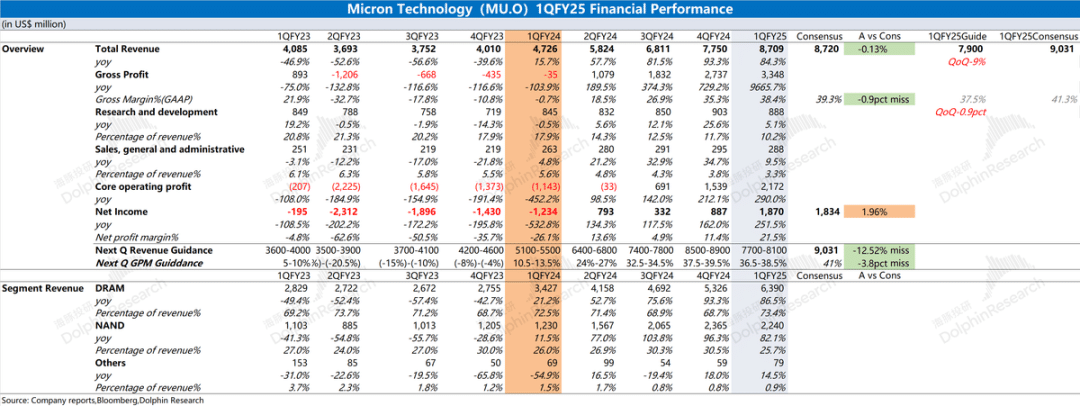

The semiconductor market is experiencing boom and bust cycles. NVIDIA, for instance, has issued a 40% yearly fall in the company’s main business warning. Micron has also issued a warning about the fast diminishing demand in various markets. According to the report, the last time the semiconductor sector went through a slowdown like this was in 2019. In fact, it only lasted a short while. However, because of the fragile global economy, I am concerned that if there is an inventory adjustment. While the economy is in a recession, the industry won’t recover as rapidly as it did during the previous slump.

The market is experiencing the greatest semiconductor recession since 2001. Or at least ten years ago, it is according to Citigroup analyst Christopher Danley. And it might even be the worst downturn in almost two decades. Every business and every end market should anticipate an adjustment.

Worldwide Crisis

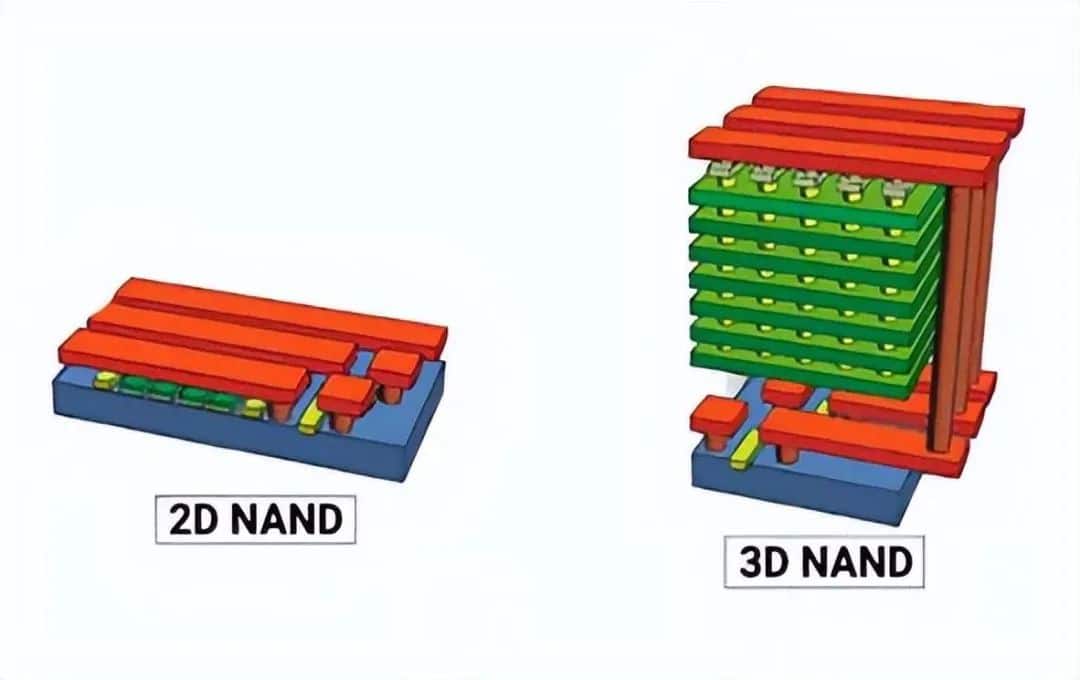

This time around, there are a number of new plants and pieces of equipment in the chip business. Governments have heavily subsidized memory industry, including those in the U.S., Europe, China, and Japan. Companies like Intel have pushed for chip legislation, claiming that American producers are more competitive than those in Asia. Now that demand is fluctuating, the corporations are getting ready to start building new capacity.

According to the Semiconductor Equipment and Materials International (SEMI), 24 new large-scale fabs will be opened globally in 2022, well above the annual average of 20 that SEMI has tracked since 2014. Total spending on equipment will reach $117.5 billion by the end of 2022, up 15% from 2021, while spending in 2023 is expected to increase to $120.8 billion.

The future of the chip manufacturing sector is questionable because of high upfront costs. The factories will need to be open 24 hours a day in order for the up to $20 billion in investments to pay off before they become obsolete. Less than five technologically advanced corporations are currently in a position to make investments of this magnitude, and three companies—Samsung, TSMC, and Intel—account for the majority of production capacity.

The semiconductor sector wants to emulate the Asian supply chain in Europe and the US, according to Fitch Ratings analyst Pompeii, which will cause sharp volatility in short-term revenue and cash flow. The short-term danger is that excessive investment may cause a collapse in the semiconductor industry given the increase in efficiency of the chip industry in the past few decades.

Leave a comment