Latest Posts

Global NAND demand triples, SSD prices may rise again.

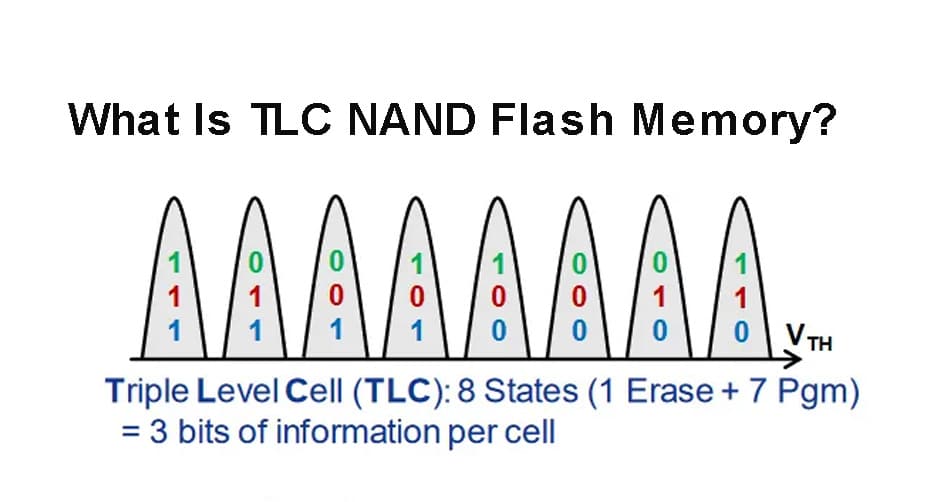

According to Kioxia (formerly Toshiba Memory), driven by the robust demand for data storage from artificial intelligence, NAND flash memory demand is expected to grow 2.7 times by 2028. for the future needs, Kioxia will introduce new process technologies and further expand production capacity in the coming years to meet the impending surge in NAND demand.

According to Kioxia (formerly Toshiba Memory), driven by the robust demand for data storage from artificial intelligence, NAND flash memory demand is expected to grow 2.7 times by 2028. for the future needs, Kioxia will introduce new process technologies and further expand production capacity in the coming years to meet the impending surge in NAND demand.

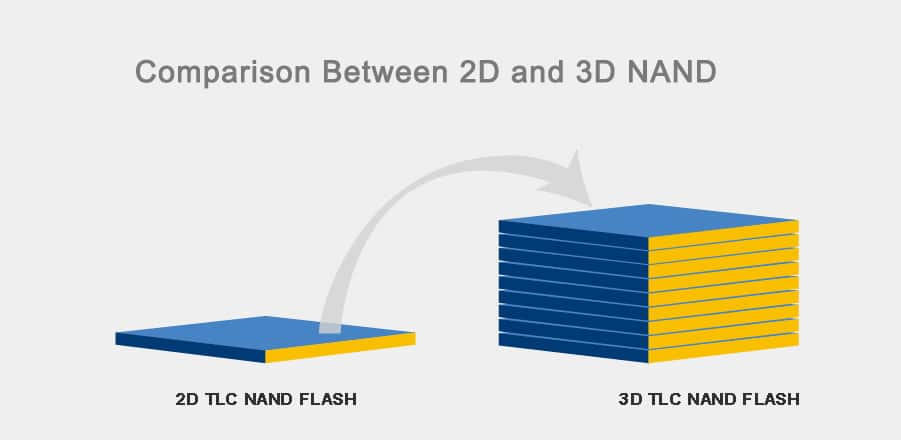

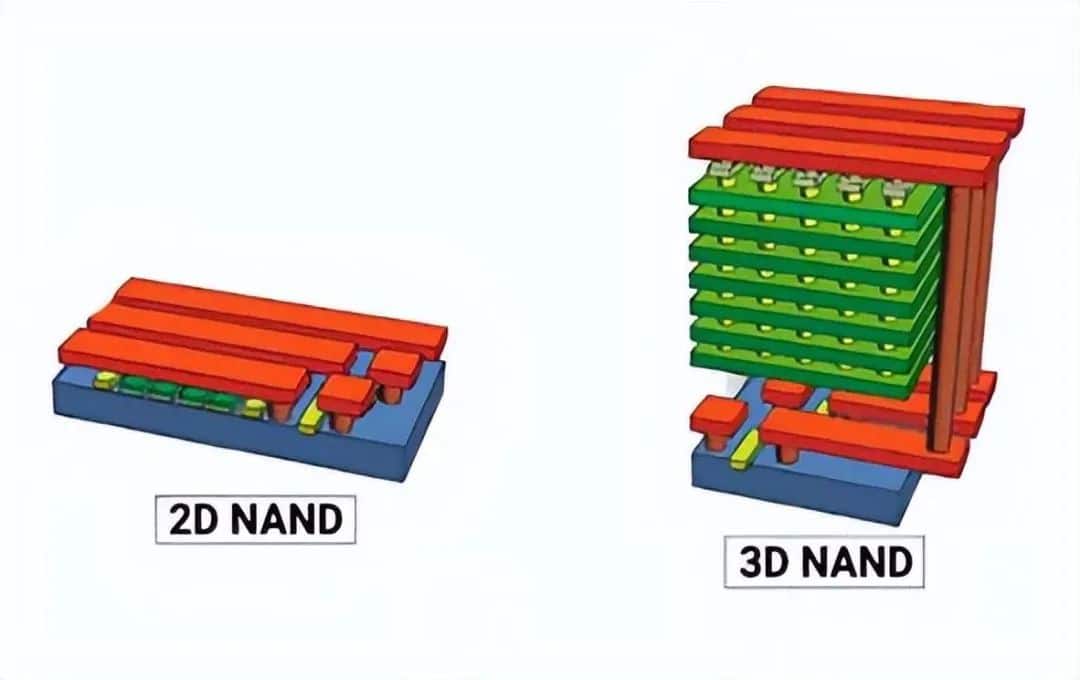

Japanese media reports: reports indicate that Kioxia is expanding its production capabilities in Japan to support future growth. In particular, Kioxia is advancing the construction of its Kitakami plant in Iwate Prefecture, aiming to commence production in the fall of next year (2025). Originally, the plant was scheduled to begin production last year, but due to a decline in the industry’s demand for flash memory, its production schedule has been repeatedly altered. The new plant’s capacity, combined with Kioxia’s production capacity in Yokkaichi, will provide Kioxia with sufficient capacity to meet future market demands. In October, due to the negative sentiment of potential investors, Kioxia abandoned its IPO plans. Therefore, this forecast may be aimed at bolstering investor confidence in 3D NAND flash memory (especially Kioxia’s products) and re-emphasizing the plan to start production at the second Kitakami plant. Earlier this year, Kioxia resumed full production at its Yokkaichi and Kitakami plants. Due to weak demand for 3D NAND flash memory used in smartphones, Kioxia had previously reduced production by more than 30% starting from October 2022.

With the decline in flash memory inventory and the recovery of the smartphone and PC markets (Japan was the most evident regional market for global PC recovery in Q3), the demand for 3D NAND also began to recover in the second half of 2023. The demand for storage chips in the terminal equipment market began to stabilize, while the demand for data centers surged with the AI boom. As the global market’s demand for AI servers and data center-grade storage devices continues to grow, Kioxia not only has the production capacity for 3D NAND but also offers enterprise-level SSDs, including flash memory controllers and firmware, to meet the robustly growing SSD demand. Other factors that may drive 3D NAND demand include AI experiences on devices, which also require high-capacity, high-performance local storage.

The Japanese government has provided Kioxia and its partner WD (Western Digital) with subsidies of up to $1.64 billion to expand production capacity by expanding the Yokkaichi and Kitakami plants—since Kioxia is considered a key player in the global 3D NAND market by the Japanese government and aligns with Japan’s strategic goals to revitalize the semiconductor industry.

Leave a comment