Latest Posts

2018 Global Semiconductor R&D Surpasses $60B: China’s IC Innovation & Major Tech Projects Unveiled

According to ChipInsights, 18 semiconductor companies worldwide invested over $1 billion each in R&D during 2018, totaling $50.3 billion—an 8% increase from 2017. Global semiconductor R&D spending is projected to surpass $60 billion, reaching between $64 and $65 billion.

The top 10 semiconductor firms alone spent $39.6 billion on R&D in 2018, marking a 7.62% year-over-year growth. Intel led the pack with a record $13.5 billion R&D expenditure, representing 29.72% of its annual revenue and 34% of the top 10 companies’ combined R&D budget.

Rising IC development costs have driven increased R&D investments across the semiconductor industry (ChipInsights).

|

Key Semiconductor Projects in China (2019)

|

|||

| City | Projects | Investment | Focus Areas |

| Wuxi | Jacal Sensor, SIASUN Robotics, Murata Capacitor | $297.7B (301 projects) | Advanced manufacturing, IC testing |

| Xuzhou | Kempur Photoresist, Hans Semiconductor | ¥175.64B (228 projects) | Photoresist, MEMS, lithography |

| Jinjiang | Ecochip, Hejiaxin, Sanwuwei IC Design | N/A (3 projects) | Optical chips, III-V ICs |

| Guangzhou | National Chip Project (NXP/IBM tech) | $14.5B (23 projects) | Embedded CPUs, RAID storage |

2. Top 10 Chinese IC Design Companies Accelerate Innovation

TrendForce’s “China Semiconductor Industry Analysis Report” reveals China’s IC design sector generated ¥251.5 billion ($36.7B) in 2018, growing 23% annually. Huawei’s HiSilicon, UNISOC, and Omnivision topped the revenue rankings. Despite shifting domestic demand in 2019, growth is forecast to slow to 17.9% (¥296.5B output) due to weaker consumer electronics and global economic headwinds.

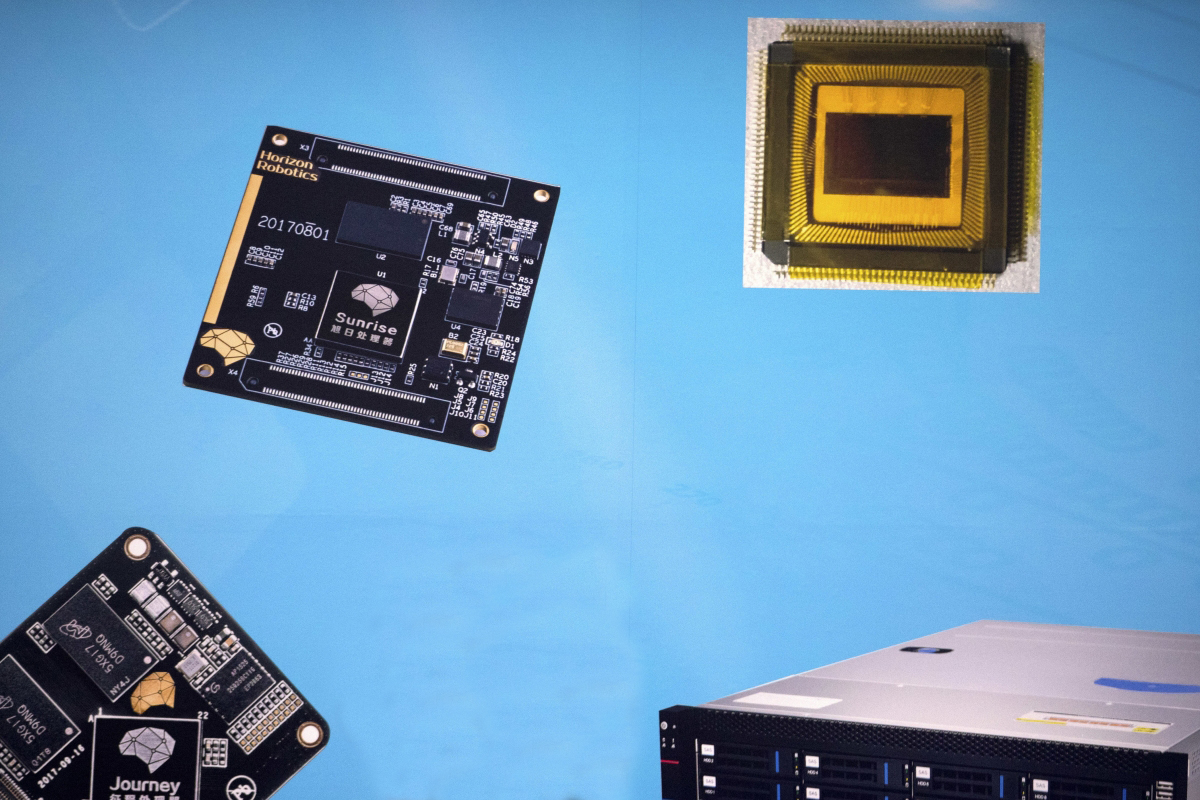

Three Chinese IC design firms surpassed $1 billion revenue in 2018, with four top-10 companies achieving over 20% growth. However, two firms faced double-digit declines. Breakthroughs like HiSilicon’s 7nm SoC mass production and 5G baseband chip leadership highlight China’s technical progress. Baidu, Huawei, Cambricon, and Horizon further demonstrated advancements in AI processors. Despite this, China’s IC chip self-sufficiency remains at 15%, dominated by low-end products. Future growth depends on accelerating R&D for mid-to-high-end chip independence (Global Semiconductor Watch).

3. Wuxi Launches 301 Strategic Projects Worth $297.7 Billion in 2019

On February 19, Wuxi City initiated 301 high-impact projects focused on strategic emerging industries, advanced manufacturing, and modern services. Key semiconductor projects include: – Jacal Electronic Image Sensor R&D/Production – SIASUN Robot Industrial Park – Honghu Multi-Chip Optocoupler IC Testing Base (Phase I) – Murata’s New Ceramic Capacitor Factory – China Resources 8-inch Wafer Facility – Osram Optoelectronic Semiconductor Phase II – Air Liquide Gas & Materials Expansion – Mako Semiconductor Equipment Cleaning (Wuxi Release).

| 2018 Global Semiconductor R&D Spending Overview | |||

| Metric | Value | ||

| Total Global R&D Spending | Exceeded $60 billion | ||

| Top 10 Companies’ R&D Total | $39.6 billion (+7.62% YoY) | ||

| Intel’s R&D Expenditure | $13.5 billion (29.72% of revenue) | ||

| Companies Spending >$1B in R&D | 18 companies ($50.3B total) | ||

| Projected 2019 R&D Spending | $64–65 billion | ||

4. Xuzhou Advances 228 Industrial Projects with $25.3 Billion Investment

Xuzhou’s February 18 groundbreaking included 228 industrial projects totaling ¥175.64B ($25.3B), averaging ¥770M ($111M) per project. Semiconductor highlights: – Xuzhou Economic Zone Silicon Carbide Initiative – Hans Semiconductor Module (Pei County) – Navigational Chips & Infrared Detectors – Pizhou Micro-Photoresist Plant (Kempur, ¥1.5B) – Jiangsu Shanghe IC Packaging/Testing – Leuven’s 12-inch Memory Etcher Expansion – Hicore’s Voice Chip Design. Xuzhou’s IC cluster spans economic zones and Pizhou, prioritizing materials (polysilicon, photoresist), equipment (lithography), and phased expansion into wafer manufacturing and chip design (China Electronics News).

5. Jinjiang Signs 100 Projects Including Ecochip & Sanwuwei IC Deals

Jinjiang’s February 19 signing ceremony featured three IC industry projects: – **Ecochip**: Optical communication chip designer (listed 2015) focusing on low-end localization. – **Hejiaxin**: Emerging packaging materials startup (est. 2018). – **Sanwuwei**: IC design/R&D firm backed by Fujian Anxin Industrial Fund, targeting III-V compound semiconductors and mergers. Anxin Capital’s ¥50B fund aims to build Fujian’s IC industrial park, supporting Sanan Group’s global expansion (Jiwei Info).

6. Guangzhou Secures $14.5B National Chip Project with NXP/IBM Tech

Guangzhou’s February 20 signing of 23 projects (total $100B+) included the National Chip Project by Suzhou National Chip Technology. Leveraging NXP multi-core CPUs and IBM RAID storage IP, the initiative targets high-end embedded CPUs and trusted servers. With design firms (Techtotop, Runxin) and packaging leaders (Fastprint, Fenghua), Guangzhou aims to close Guangdong’s manufacturing gap and establish a full IC ecosystem (China Electronics News).

Leave a comment