Latest Posts

Effective today, the United States cuts off the supply of EDA software, the “mother of chips”

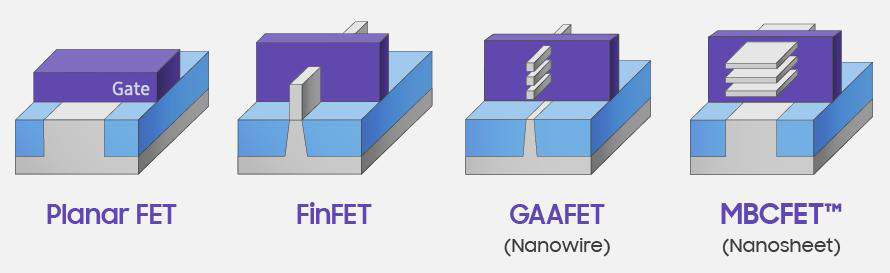

The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued an interim final rule on August 13, mainly to control the export of four technologies, including wide-bandgap semiconductor related materials gallium oxide (Ga2O3) and diamond; especially ECAD (Electronic Computer-Aided Design) software for GAAFET (full gate) transistor structures; Pressure Gain Combustion technology used in gas turbine engines. August 15th marks the start of the ban.

The ECAD here can basically be narrowed down to the EDA tool we often say.

This export control policy, which is an enlargement of earlier export limitations, does not directly target China, but it is obvious that it has continued to impede the advancement of semiconductor technology in nations and regions that compete with the United States. The most intriguing of the four technologies is “EDA software specifically for GAAFET transistor architectures” . As early as early this month, overseas media reported that the Biden administration would enact a new export ban aimed at EDA software, which is used in the state-of-the-art chip manufacturing.

Which chips will be impacted if the EDA supply is stopped?

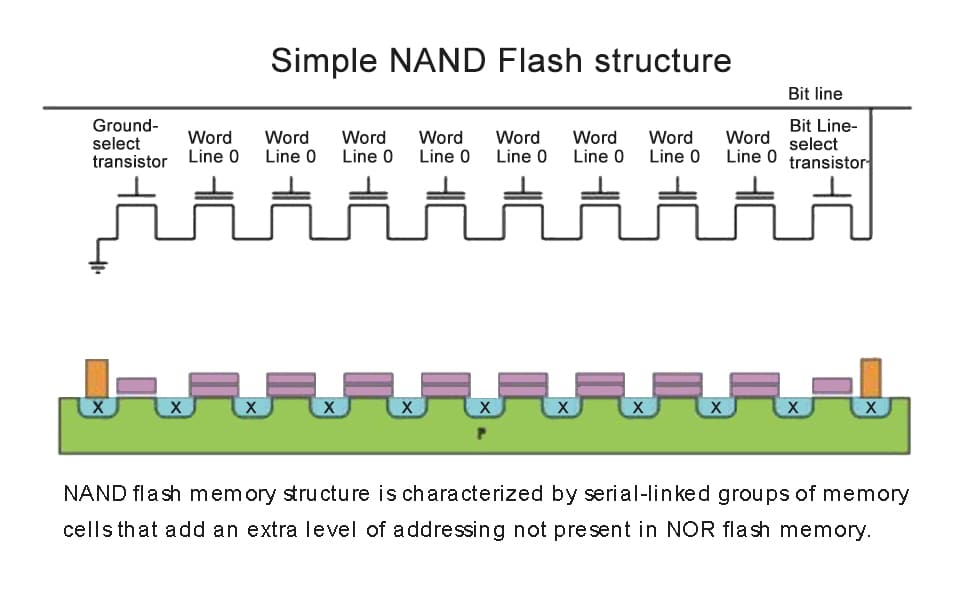

EDA is a category of software tools for designing electronic systems such as integrated circuits and printed circuit boards. It is indispensable for chip design. It is the upstream industry of chip manufacturing, covering all processes such as integrated circuit design, routing, verification, and simulation. And EDA is called the “mother of chips” in the industry.

At the moment, three American firms—Cadence, Synopsys, and Mentor—largely control the global EDA software market. The three American market leaders who control more than 70% of the global EDA market share are able to offer complete EDA tools that cover practically the whole integrated circuit design and manufacturing process.

This time, EDA software for the GAAFET transistor structure is subject to U.S. export controls. The realization of 3nm and lower technological nodes depends on GAAFET. It is now being used by Samsung in the 3nm chip process technology. It is predicted that by 2025 TSMC and Intel will use it for 2nm manufacturing process.

Additionally, GAAFET transistors will only be employed in very large volumes of semiconductors in the near future, such as CPUs in PCs and mobile phone, and GPUs and AI chips in data centers . For the time being, at least until costs come down, it seems unlikely that chips used in automobiles will use such sophisticated transistors. As a result, the ban of the US Department of Commerce BIS won’t have much of an impact right away. However, based on the chip update cycle, the export restrictions will start to have a lasting impact one or two years later.

Impact on China’s chip development

All semiconductor businesses cannot escape the EDA software of the GAAFET structure once they have started the advanced process. In the future, designing chips with 2nm, 3nm, and lower processes may become more difficult for Chinese businesses that require advanced process chips, such as those in the mining and AI industries. This means that companies in China that need to use advanced process chips, such as AI chip companies and mining chip companies, etc., may be hindered in the design of chips with 2nm, 3nm and lower processes in the future.

The 2nm and 3nm processes are currently the most sophisticated ones for making chips, but Chinese chip companies are still making advancements in the 5nm and 7nm processes. Therefore, the effect won’t be felt for a while. However, in the long run, U.S. control over the export of EDA software with the GAAFET structure will obstruct Chinese chip businesses’ progress, much like the sophons in the sci-fi novel “The Three-Body Problem” obstructing Earth. That’s enough to make us cautious, then. The secret to China’s chip development now is figuring out how to get through the US blockade. According to some media commentators, the regionalization of the semiconductor sector would be further exacerbated by technological barriers set up by the US. The initial globalization of the chip manufacturing sector necessitates international cooperation. But disagreements between different parties are what’s behind the current anti-globalization situation. Not only in China, but also in South Korea, Japan, Europe, and other markets, this trend is becoming more pronounced. A significant problem in the sector seems to be the ability to master more complex technology more independently.

Leave a comment